By failing to prepare, you are preparing to fail ˜Benjamin Franklin

As per CMIE [Ref¹](Centre for Monitoring Indian Economy), approx. 18 million persons have lost their employment in April 2020. Losing jobs in the current turbulent times have added to the woes of Indians. A lot of distress calls have been doing rounds and people have been panicking due to financial losses. When life throws such nasty bombshells, do you have a second plan for yourself, for any emergency? Having this plan B in the form of an Emergency fund will certainly help you come out of this financial distress.

Related Read: Need for women to handle Financial Planning

What is an Emergency Fund?

Remember: When disaster strikes, The time to prepare has already passed ˜Steven Cyros

Emergency preparedness should be a priority as an emergency will never knock at your door and wait for you. Start on building this fund early in your life. And if you haven’t done, by the time you are reading this post, then frame your goal and start building this contingency fund.

Emergency or Contingency Fund is a pool of money (liquid money), which has been parked aside for emergency expenses. Now, these expenses can be due to serious medical emergency, a major repair to home or your car, or phase between your job-loss. Emergency funds need to be used when you face “real emergency” and should not be used for luxury expenses, like a vacation, buying any gadget, expensive gifts, and similar.

Having a well built-in Emergency fund gives one a sense of freedom to keep you afloat when life throws you out of gear due to these emergencies.

How much money should be parked as Emergency Fund?

Well, Financial experts suggest that this Emergency fund should be 3-6months of your basic expenses, to help you sail smoothly during such times. Unlike Savings accounts, you will not find Emergency accounts with any bank, as this fund build-up needs to be done at your end. Also, the corpus varies for each individual. Building up this contingency fund depends upon various factors you need to consider as, your job security, no. of earning members in your family, Elders, medically challenged people in the family, Health Insurance and its coverages, quantum of EMI you ought to pay. The more is your financial insecurity, the bigger should be your Emergency Fund, earmarked for any financial crisis you might face.

And you need to remind yourself, that EMERGENCY FUND IS A PRIORITY, which needs to be build up early in life.

How do you calculate the amount required to set up Emergency Fund?

1. Calculate your monthly basic expenses, that include:

- Rent

- Fixed EMI’s (Car, House, Credit Cards, etc.)

- Monthly Medical expenses

- Grocery and Utility Bills

- School fees

- House helps, and similar.

Usually, expenses on recreational activities like Shopping, Dining, Movies, are not included in calculating Emergency fund, as these are all optional expenses, which can be reduced to a big extent if any contingency arises.

2. From this monthly expense, calculate 3-6 months of basic expenses, that should form your contingency corpus.

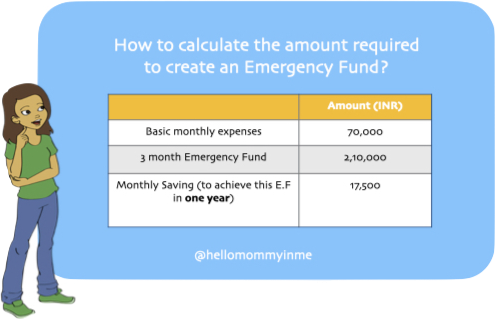

Example:

If your Monthly expense of these essential utilities comes to INR70,000 (˜930USD), then you need to build up a corpus of 2.10 lacs(3 months) – 4.20 lacs (6 months) and keep it aside tagged as Emergency Fund. If you haven’t set up this Emergency Fund, achieving these figures might seem daunting. But you need not set up all at once. Give yourself a reasonable time (not too much) to set up this fund.

Set aside a specific amount (you’re comfortable with) from your income each month. If you can pull out Rs17,500 every month, then you can set up this 3 months bare minimum Contingency Fund in one year (assuming the basic monthly expenses at Rs70,000). Growing Emergency Fund should be a priority, so you can shift extra cash inflow (bonus, tax refunds, monetary gifts from family) to this fund.

If you’re unable to calculate the corpus and monthly savings to build Emergency Fund, you can also find Online Emergency Fund calculators, with most of the banks [Ref²]

Where to Invest Emergency Funds?

The real purpose of the Emergency fund is to meet your emergency expenses. And such expenses means you need to have liquid assets. Liquid assets, are those assets that can be converted into cash in a short amount of time (within a few hours to a day), to cater to your urgent needs.

It is a thumb rule to build up this fund before you start investing in volatile Market instruments like Stocks. This current pandemic of Coronavirus has seen most of the portfolio’s turning red, with massive losses to investors. Having a cushion of an emergency fund protects your overall financial situation during such a global crisis. Hence, after you’ve arrived at the figures, investing this corpus in the right instruments should be a prime motive.

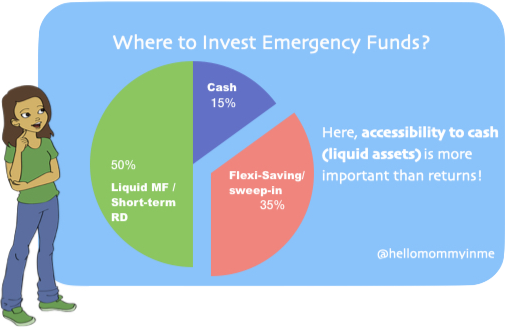

Here returns are not that important, but safe and less volatile instruments with easy accessibility to cash (liquid assets) are more important.

Normal Mutual Fund Investment and FD cannot be considered as an Emergency Fund, as these are not always liquid, and hence you need to park these funds separately.

- Cash: Depending upon your Emergency Corpus, fix a percentage of this fund as cash. Usually, 15-25% of Cash is enough.

- Flexi-savings account/ Sweep-in facility: Around 35% of the remaining fund can be invested in the Flexi-savings account/ Sweep-in facility of your bank. Usually Saving accounts give a lesser rate, while Sweep-in has a better rate than a savings account and can be easily accessible at the time of need.

- Liquid Funds: Remaining 40%-50% of the fund can be invested in Liquid Funds/RD. Liquid Mutual Funds earn a decent return and they can also be withdrawn at any moment. They are basically debt funds, which are not much affected by the interest rates. Hence they are not volatile and yet give a decent return. Usually, most of the Liquid funds allow instant redemption of 90% of the invested amount or certain fixed amount. Do check that before investing in any Liquid Fund.

We will discuss more Liquid funds in detail in another post.

Example: So taking the above example, if your 3-month fund is ˜2.10 lakhs, then keep a cash reserve of around 31k-42k at home, Invest ˜74k in Flexi-Saving / Sweep-In and Invest the remaining 94k-1lac in Liquid MF’s.

Should you use Credit cards as Emergency Funds?

No, you should not use Credit cards as Emergency Funds! Numerous people today depend on Credit cards to cover their unexpected expenses. Well, this isn’t a good financial move. Using credit cards under the emergency is like taking a new loan. And this new loan is because you cannot fund your existing expenses. Remember you need to pay this amount back, and accumulating interests on credit cards can be quite hefty. This will rather act as an additional expense from your kitty and a huge burden if you aren’t able to pay your monthly credit card bills.

Hence, it is always judicious, to dig into your emergency funds, during such a crisis. Revisit and keep on updating your contingency fund. An additional family member, inflation, extra EMI, might trigger changes to your corpus. On a personal level, we try to update our funds, at least once a year, or if there have been any major changes in our Lifestyle.

You should do that too!

This series is a part of #MoneymantrawithJhilmil , wherein I’m discussing Money management to empower women financially. You can also check out my videos on Instagram (IGTV) under the series Money Mantra With Jhilmil!

Ref1 https://www.cmie.com/kommon/bin/sr.php?kall=warticle&dt=2020-05-05 08:22:21&msec=776 Ref2 https://www.axisbank.com/retail/calculators/emergency-fund-calculator

Stay Aware, Stay Empowered!

Much Love,

Thanks for giving in detail the money mantra jhilmil. I will wait for your next post on liquid funds.

It is prudent to always save something for a ‘rainy day’, and this comes in handy for those unforeseen emergencies.

There should be a strong emphasis on saving money as emergency fund. The whole world has learnt this the heard way. In India, however, there has been an old saying implying one must save 10 paisa out of a rupee for hard times.

This is such an eye opening post for me; im not particularly wise in this arena and do need a strong guidance like this. But i have surely learnt a lot from you post.

Now this is a post I really needed to read! I didn’t know what an emergency fund is! Thank you for sharing about it! I will try to build it for myself!

Yes, there should be an emergency fund for the crisis period. That’s quite a helpful post.

An emergency fund is best to provide a safety net against surprise financial setbacks. This is best easily accessible savings account intended to help pay for unexpected expenses. GREAT THOUGHTS.

This is one of the best guide on emergency fund. I had not much idea on the same but now I have .. Thanks,dear